Investing

21-11-2024 12:16

6 Views

Unlock Your Fortune: A 2024 Guide to Profiting from Tin Stocks!

Title: Maximizing Profits by Investing in Tin Stocks: A Comprehensive Guide

As we move further into the 21st century, seeking innovative and profitable ways to invest our money becomes more crucial. With the rapid developments in technology and construction, the demand for certain metals is skyrocketing. Among these, tin is one metal that has quietly risen in importance due to its versatile applications in various industries. This article examines the hows and whys of investing in tin stocks and how it could be a viable investment avenue for you.

Why Tin Stocks?

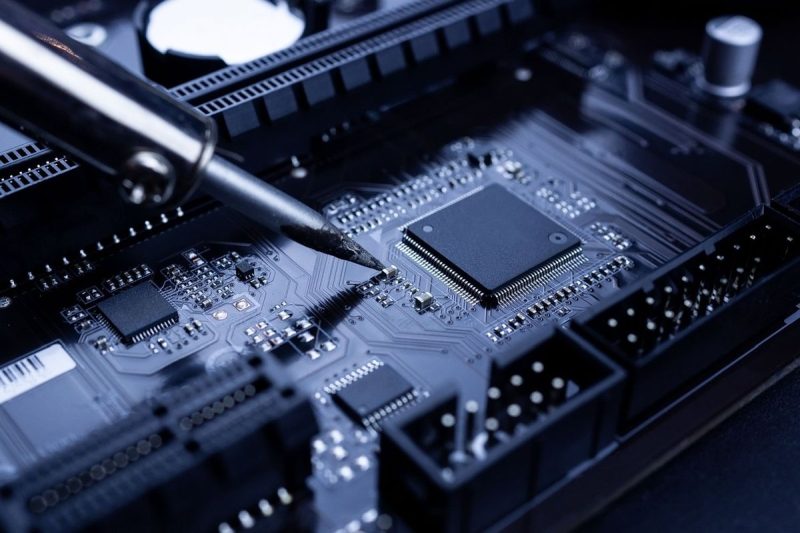

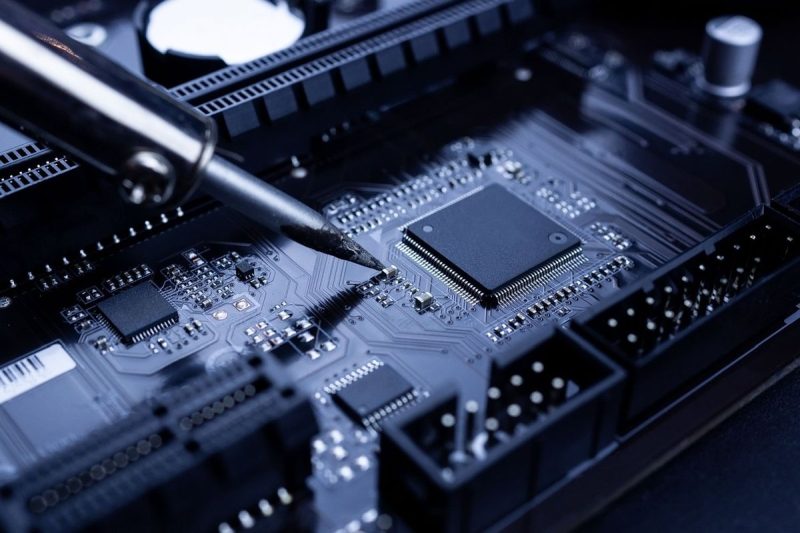

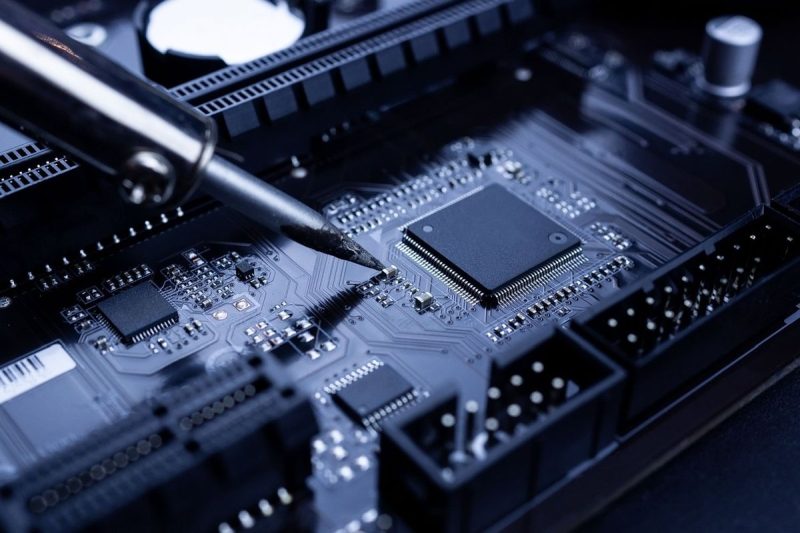

Tin is a crucial resource in the production of consumer electronics such as mobile phones and tablets, automobiles, and in the construction industry. With these sectors showing no signs of slowing down, the demand for tin persistently increases. This steady and growing demand ensures that investing in tin stocks could bring about substantial returns for proactive investors.

How to Begin Your Journey in Tin Investment

The first step to delve into the world of tin investment is diligent research. Understand the global tin industry, major producers worldwide and their projected output, current prices, and future trends. It's also crucial to research the specific companies you are considering investing in. This involves analyzing their financial health, management team, recent performance, and future plans.

Decoding the Tin Market

Tin's strong demand usually outstrips its supply, making it a ‘seller's market'. However, the tin market is also influenced by geopolitical and economic factors. These factors create fluctuations in tin prices that could impact the profitability of your investment. A well-versed investor understands these dynamics and is prepared to navigate them skillfully.

Assess the Risks

Like any investment, tin stocks come with their set of risks. The price of tin can be highly volatile and is subject to global economic fluctuations. Regulatory changes, supply disruptions due to political instability or natural disasters, and company-specific issues can significantly impact the value of your investment.

Balancing Your Portfolio

While the prospects of investing in tin stocks can be enticing, it’s essential to remember to maintain a diversified portfolio. Allocating a proportion of your investment to tin stocks can help spread out investment risks and potential rewards.

Investment Routes

There are numerous ways to invest in tin stocks, including buying shares in tin mining companies, Exchange-Traded Funds (ETFs) that track the price of tin, or futures contracts if you're an advanced investor.

Choose your preferred method based on your risk tolerance, understanding of the market, and investment goals.

In conclusion, investing in tin stocks offers a promising avenue for shrewd investors ready to delve into the intricacies of the tin market. As the industrial demand for tin shows no signs of abating, now may be an opportune moment to begin your journey in tin investment. However, thoroughly researching the market, understanding the risks, and maintaining a balanced portfolio is pivotal to your success.

When done right, an investment in tin stocks could become a valuable addition to your diverse portfolio. After all, the future of technology and construction is intertwined with tin's fortunes, and investing in it today might just pave your path for a lucrative tomorrow.